Meeting Your Needs

You’re unique. Your investment and financial needs require a distinctive and individualized approach to wealth management and financial planning. Whether your goals are immediate or long term, the professionals at Trustco Wealth Management are dedicated to protecting your wealth and managing its growth by utilizing prudent, time-tested techniques.

Our financial planners, in concert with your attorney and/or accountant, work with you to design a plan that meets your current and future financial needs. If you prefer a hands-on approach, we have an extensive network of branches in Florida and New York with teams excited to help you reach wealth management goals.

Detailed and skillful planning begins with questions related to your financial situation and goals

- Do you have a Will that effectively passes your wealth to your family or favorite charitable organizations?

- Does your investment portfolio balance income and growth with an appropriate level of risk?

- Do you own special assets, such as an investment real estate, that requires special estate planning measures?

- Does your financial plan take advantage of current opportunities to reduce the impact of estate taxes?

For answers to these questions and further information, contact a Trustco Wealth Management representative today, or contact us at 1-800-670-3110 or 518-381-3643.

Trustco’s Commitment.

The delivery of Investment and Trust Services has changed dramatically in recent years. At brokerage firms and “big banks,” customers with less than $1,000,000 are rarely afforded the benefit of a portfolio of individually selected and managed securities, and are instead delegated to a family of mutual funds.

Trustco Wealth Management remains committed to providing personalized investment management, trust administration and estate settlement. Begin enjoying the benefits of competitive investment performance, accurate trust and estate administration, and personalized customer care with Trustco Wealth Management.

A Bank Built on Trust.

For over 120 years, Trustco Bank has played an integral role in the creation, growth, preservation, and ultimate transfer of our clients’ wealth. The Trustco Wealth Management Group has made a commitment to creating successful investors by listening to our clients’ concerns and goals and conducting regular assessment and planning discussions.

Let over 150 years of combined experience work to your advantage, while our planning and investment professionals

Financial Tips

Below are a few tips from Trustco Banks Administrative Vice President of Wealth Management, Patrick LaPorta, Esq. Click on the files below to hear Patrick talk about each of these topics. If you have additional questions or would like to learn more, contact a Trustco Wealth Management representative today, or contact us at 1-800-670-3110 or 518-381-3643.

1. Estate Planning

You can also listen to the audio file below to hear the above part of the speech.

2. Asset Allocation

You can also listen to the audio file below to hear the above part of the speech.

3. Retirement Planning

You can also listen to the audio file below to hear the above part of the speech.

4. Your Retirement Years

You can also listen to the audio file below to hear the above part of the speech.

5. Bill Payment Services

You can also listen to the audio file below to hear the above part of the speech.

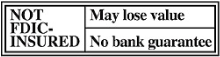

Non-deposit investment products.

Common Factors Affecting Retirement Income

When it comes to planning for your retirement income, [...]

Maintaining Your Financial Records: The Importance of Being Organized

An important part of managing your personal finances is keeping [...]

Growth vs. Value: What’s the Difference?

With the wide variety of stocks in the market, [...]

Balancing Work and Family

Balancing work and family is a highly personal endeavor, and there is no magic formula. It takes planning and resolve.

Advanced Estate Planning Concepts for Women

You will need to think about the disposition [...]

529 Savings Plans

A 529 college savings plan is a type of qualified tuition program (the other type is a prepaid tuition plan) established under Section 529 of the Internal Revenue Code.

Planning for Incapacity

Plan Ahead Should you become incapacitated without the proper [...]

Financial Basics for Millennials

With age comes responsibility, so if you're a young adult [...]