Wealth Management Resources

A trust for your spouse can provide generous support if he or she survives you. In addition, trusts can frequently reduce federal estate taxes for a husband and wife by reducing the tax liability at the survivor's death. When children or other beneficiaries are young or financially inexperienced, the need for a trust is clear. However, the trust provisions need not be rigid.

Trustee Discretion

A beneficiary need not be limited to the income from a trust fund. You have the option of giving the Trustee discretion to utilize the principal of the trust for a variety of purposes, such as paying for a child's education or maintaining your spouse's standard of living. Our Trust professionals keep in close contact with your family and exercise your intentions with prudence and understanding.

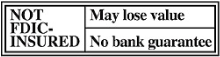

Non-deposit investment products.