Wealth Management Resources

To start with, we sit down with you to develop carefully focused objectives for your account based on your income requirements, your tax status, the nature and extent of your other holdings, tolerance for risk, and your personal attitudes as an investor.

Once an investment objective and optimal asset allocation have been identified, your portfolio is reviewed on a regular basis and appropriate changes are made to meet the needs of your current financial situation and long-term goals. Then we provide continuing, attentive management based on those objectives.

Every investment decision we make for your account -- or if you prefer, every recommendation submitted for your approval -- represents our informed, independent judgment of the best course of action for you. Your portfolio manager keeps in close contact, year in and year out, to ensure the character of the portfolio is consistent with your needs and objectives. As your requirements change, your portfolio is adjusted to meet your new aims.

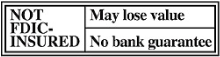

Non-deposit investment products.