Wealth Management Resources

Planning for an Estate Settlement

We administer your Estate and protect your assets. We plan for the tax-efficient transfer of your wealth. Have you planned for the transfer of your wealth at death? Selecting a qualified executor is a key component of an effective Will.

Your executor must decide what assets to sell and when to pay taxes and estate expenses. Also, your executor needs to make timely and accurate distributions to your beneficiaries or to the trusts you establish for their benefit.

The Characteristics of An Ideal Executor Include:

Please Note: We reserve the right to alter or withdraw these products or certain features thereof without prior notification.

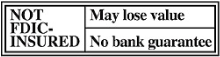

Non-deposit investment products.