All Faq

- ATM/Debit Card

- CardValet

- Customer Alerts E-mail/Test Alerts

- Customer Services

- E-Statements

- General Banking

- Mobile Banking

- Mobile Deposit

- Mobile Wallet

- Online Banking

- Security

- Zelle

Trustco Bank was founded in Schenectady, New York in 1902 and is now headquartered in Glenville, New York. Trustco has over 140 branches spread among New York, Florida, Massachusetts, New Jersey and Vermont.

TRST is the stock symbol for Trustco Bank.

Trustco Bank offers a wide variety of deposit and loan accounts. For additional information on any of these accounts, click on the links below:

Visit a Trustco Bank location near you and a branch manager will help you set-up your new Trustco Bank account. Please take your photo ID and any supporting documents, if applicable.

Visit a Trustco Bank location near you and a branch manager will make this process easy for you. They will assist you with transferring your automatic payments and deposits to Trustco Bank with ClickSwitch®.

To change your name on your accounts, please take your updated photo ID and any supporting documents (i.e. marriage certificate, divorce, or other court orders) into any of our Trustco Bank locations. We will update our records and your signature card with your new name.

To change your address on your accounts, please take your photo ID into any of our Trustco Bank locations. We will have you fill out a change of address form and update our records appropriately. If you are unable to visit one of our branches please fill out the attached form and send your request to: PO Box 1082, Schenectady NY 12301-1082. Please allow 7 to 10 business days for your request to be processed.

You can contact our automated 24 hour telephone banking system at 1-800-670-4110. If you need assistance with your debit card, call 1-800-670-3110 (24 hours).

You can also access your accounts using our online banking 24 hours a day.

Prior to your maturity date, you will receive a Certificate of Deposit renewal notice in the mail. You have a 10-day grace period after the maturity date, during which you can select a different term or deposit additional funds. If no action is taken, your CD will automatically renew for the same term and at the then current rate of interest. Simply contact your local branch or visit the branch location to renew your CD.

You can easily transfer funds by telephone using our automated 24 hour telephone banking system at 1-800-670-3110. You can also transfer funds at ATM machines or online, using our online banking. If you would feel more comfortable speaking to someone, contact any of our branch managers and they would be glad to assist with transferring funds.

Visit any Trustco Bank location and a branch manager will happily assist you with the Debit Card application.

Trustco Bank Debit Cards should be delivered within 7-10 days from the time of the request.

Once you receive your Trustco Bank Debit Card, you can activate the card and choose a personal identification number(PIN) by calling 1-877-744-2274. You will be prompted to answer security questions to verify your identity to activate the card and will then be prompted to choose a PIN of choice. Please be sure to have your business tax identification number available for business debit cards. Sign your name on the back and you can begin using it immediately.

If you know your current PIN but would like to update it to a new PIN, call 1-877-267-5986 and follow the instructions to choose a new PIN.

A. If you do not know your current PIN, please call Customer Service to verify your identity at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday).

Multiple accounts can be linked to a Debit Card as long as the cardholder is an account owner on all accounts requested to be linked. Only one Home Town Premier or Home Town Free Checking Account will be flagged as the Default Point of Sale Account. The remainder of the accounts linked to the Debit Card would have access to complete ATM withdrawals.

Statement Savings Accounts have access to ATM’s only. Health Savings Accounts have access to Merchant Point of Sale Terminals only for qualified health purchases and will be linked to a Health Savings Account Card.

Yes, There is a daily limit of $500.00 for ATM Withdrawals and $3,500.00 for Merchant Point of Sale Terminal Transactions.

There are no debit card fees for transactions or balance inquiries if completed at:

- Point of Sale Terminals

- a Trustco Bank ATM.

- An AllPoint Network ATM

- ATM’s within Publix Supermarkets

All other Non-Trustco ATM’s will assess the following fee’s:

- $2.95 will be charged for each balance inquiry.

- $2.95 will be charged for each domestic transaction.

- $5.00 will be charged for each international transaction.

- Additional fees may be charged by the owner of Non-Trustco ATM’s

Your Debit Card can be used for purchases at millions of locations around the world that accept MasterCard debit cards. This includes restaurants, gas stations, retail stores, purchases on the internet, ATMs, etc.

Since your Trustco Bank Debit Card has a MasterCard® logo on it, you can process your payment as a credit purchase. By choosing credit, you may be required to sign the receipt and the funds will be deducted from your account.

Some businesses require that you enter your PIN. You will be prompted at the terminal to enter your PIN and the funds will be deducted from your account.

Use our Trustco Bank branch locator or the AllPoint Network locator for a list of ATM locations. Most of our ATMs can be accessed 24 hours a day.

You can track all of your Debit Card transactions 24/7 by enrolling in online banking and/or mobile banking. Real-time transaction alerts can be received by downloading the CardValet application on your mobile device. You can also enter your transactions in your checkbook register, and every purchase will appear on your monthly checking account statement.

Yes. Whether you are traveling domestically or internationally, it is important to notify the bank to avoid transactions from being denied. Contact Customer Service at 1-800-670-3110 or any Trustco Bank location. You will need to inform them the dates and locations you will be traveling to.

Immediately contact customer service 24/7 at 1-800-670-3110 to report your card lost or stolen. A replacement card can be requested by contacting your local branch or call customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday).

Call/visit your local branch or call customer service at 1-800-670-3110 to dispute the unauthorized transactions (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday).

Trustco Bank has 24/7 fraud monitoring of Debit Card transactions to check for abnormalities in transaction activity and/or location. Transactions may be blocked and you will be notified to confirm by text (if a mobile number is on record), phone call, and/or mailed notification in the event a transaction appears to be fraudulent. It is still important to monitor your account activity as not all fraudulent transactions can be caught by Trustco Bank’s fraud monitoring.

Yes. Trustco Bank Debit Cards are compatible with Apple Pay, Samsung Pay, and Android Pay. Please visit the Mobile Wallet FAQ’s for additional information on how to enroll and use.

Some merchants will request an authorization for a “general” amount. The authorization amount can be lower or higher than the actual transaction amount. The authorization will show as a pending transaction and will place a hold on funds affecting your available balance. At the time the transaction settles, your account is charged the actual amount of the transaction and the authorization is removed. For Example:

For gas purchases an authorization is requested prior to dispensing fuel. Most pay-at-the-pump gas purchases are initially authorized for $1. Only the actual amount of the purchase will post to your account when the transaction settles.

For restaurants an authorization prior to a tip being added. In this case, the authorization amount may be lower than the actual transaction amount. When the transaction settles you will be charged the final purchase amount (total bill + tip).

For Hotel/Cruise/Car Rental an authorization in the amount equal to the entire stay plus an estimated amount for incidentals may be used. This can also be true for car rentals and cruise lines, which may include deposits and/or other fees.

Your new Debit card will arrive within two weeks from the 1st of the month. Your current card is good through the last day of the expiration month that appears on the front of your card. If you do not receive your new card within two weeks from the 1st of the month, contact your local Trustco Bank location or Customer Service at 1-800-670-3110.

No. Purchase receipts will only display the last four digits of your Debit Card number. However, it is always good practice to keep your receipts in a secure place.

Yes. Once enrolled in our online banking, you can receive alerts and reminders about balances, transfers, and other account activity..

You can set-up alerts to be delivered via text message or email.

Yes you can have multiple email addresses or multiple cell phones linked to receive alerts and reminders.

Once enrolled in our online banking, click "Other Services" and then click "Alerts". Follow the steps to complete the alert set-up process.

Once enrolled in our online banking you can set-up as many alerts and reminders as you like for free. Standard messaging and data rates may apply and vary by carrier.

In the "Other Services" menu, click "Alerts" then enter additional email addresses and click "Save" when finished.

To add a cell phone, follow the addresses listed below that correlate with your cell phone provider. The addresses also are entered in the "Additional E-Mail Address" field

The list below contains the largest cell phone providers. For additional text formats please contact customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) or your cell provider.

- AT&T: 10digit@txt.att.net (Ex. 5551234567@txt.att.net)

- Verizon: 10digitphonenumber@vtext.com

- Alltel: 10digitphonenumber@message.alltel.com

- Nextel: 10digitphonenumber@messaging.nextel.com

- Sprint: 10digitphonenumber@sprintpaging.com

- T-Mobile: 10digitphonenumber@tmomail.net

After you have successfully entered your mobile phone text message address follow the steps to complete the set-up process. You will receive a text message with a confirmation code. You will need to enter this to complete the set-up process.

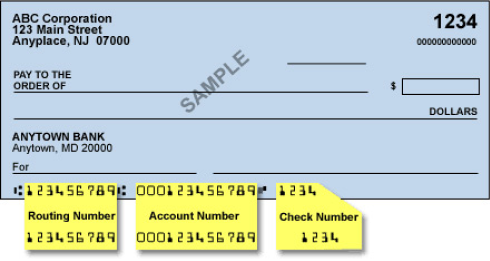

For New York, Vermont, Massachusetts, New Jersey customers, Trustco Bank’s ABA routing number is 021300912. For, Florida customers 063192450.

You can reorder checks online (Order Checks online). You can also contact customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) or visit any Trustco Bank location.

You can stop a payment using our online banking. If you prefer, you can contact customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) or visit any Trustco Bank location. You will need to provide the check number, the amount of the check, the date the check was written and the payee. The current fee for a stop payment is $30.

It’s easy to obtain a copy of your checks using our online banking. You have access of your check images 24 hours a day directly online. You can also visit any Trustco Bank location or contact customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) for this request.

You can access our automated 24 hour telephone banking system by calling 1-800-670-4110.

Determining the availability of a deposit

The length of the delay is counted in business days from the day of your deposit. The Bank’s cut-off hour for receiving deposits is the time of branch closing which varies at different locations. A deposit or withdrawal made prior to the Bank's processing cut-off time Monday through Friday will be applied on the day it is made; a deposit or withdrawal made after the Bank's processing cut-off time or on a Saturday, Sunday, or legal holiday will be applied on the next business day.

The length of the delay varies depending on the type of deposit and is explained below.

Same Day Availability

Funds from electronic direct deposits to your account will be available on the day we receive the deposit.

Next Day Availability

Funds from the following deposits are available on the first business day after the day of your deposit:

- U.S. Treasury checks that are payable to you.

- Wire transfers.

- Checks drawn on Trustco.

If you make a deposit in person to one of our employees, funds from the following deposits are also available on the first business day after the day of your deposit:

- Cash

- State and local government checks that are payable to you (if you use a special deposit slip available from Trustco).

- Cashier’s, certified, and teller’s checks (if you use a special deposit slip available from Trustco).

- Federal Reserve Bank checks, Federal Home Loan Bank checks, and postal money orders, if these items are payable to you.

If you do not make your deposit in person to one of our employees (for example, if you mail the deposit), funds from these deposits will be available on the second day after the day of your deposit.

Checks

The first $225 from a deposit of checks will be available on the first business day after the day of your deposit. The remaining funds will be available on the second business day after the day of your deposit.

For example, if you deposit a check of $700 on a Monday, $225 of the deposit is available on Tuesday. The remaining $475 is available on Wednesday.

Longer Delays May Apply

Funds you deposit by check may be delayed for a longer period under the following circumstances:

- We believe a check you deposit will not be paid.

- You deposit checks totaling more than $5,525 on any one day.

- You redeposit a check that has been returned unpaid.

- You have overdrawn your account repeatedly in the last six months.

- There is an emergency, such as failure of communications or computer equipment.

- You deposit a check in U.S. funds which is not drawn on a bank located in the U.S.

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when the funds will be available. They will generally be available no later than the seventh business day after the day of your deposit.

Special Rules for New Accounts

If you are a new customer, the following special rules will apply during the first (30) days your account is open.

- Funds from electronic direct deposits to your account will be available on the day we receive the deposit. Funds from deposits of cash, wire transfers, and the first $5,525 of a day’s total deposits of cashier’s, certified, teller’s, traveler’s, and federal, state, and local government checks will be available on the first business day after the day of your deposit if the deposit meets certain conditions. For example, the checks must be payable to you and you must use a special deposit slip available from Trustco. The excess over $5,525 will be available on the ninth business day after the day of your deposit. If your deposit of these checks (other than a U.S. Treasury check) is not made in person to one of our employees, the first $5,525 will not be available until the second business day after the day of your deposit.

Funds from all other check deposits will be available on the ninth business day after the day of your deposit.

Visit or contact your local branch immediately. A branch manager will assist you in disputing this transaction.

An E-Statement is an electronic version of your statement with images available online via our Internet site. You can view and print your statement right from your computer, avoiding the wait for traditional mail.

No longer want to receive paper statements? You can receive your statements and check images through our online banking system. Here are some great reasons to go paperless:

Simple – Less paper to keep track of.

Fast – You’ll receive an email notification when your statement is available.

Convenient – View and print your statements anytime.

No. e-Statements are a free service once enrolled in our online banking.

Yes, you must have online banking access in order to view your e-Statements.

No. Once enrolled in our online banking you will have immediate access to your e-Statements.

Once enrolled in our online banking, click the statements button under the Accounts tab then click e-Statements and follow the instructions to enroll in e-Statements.

Loans, Checking, Money Markets, and Statement Savings accounts are eligible to be received as e-Statements.

You can login to view your e-Statements at any time! Your e-Statements will be available within 24 hours after your statement cycle ends. We will send you an email alerting you that your e-Statement is ready for viewing.

Yes, your e-Statement is exactly the same as a paper statement.

Yes, your check images (front and back) are included with your statement.

Yes. Once you open the e-Statement you will be able to print it just like you print any document on your computer.

Once e-Statements start, your paper statement will no longer be produced. Since either owner on an account can request an e-Statement, the other owner may have signed up for e-Statements and the paper statement is no longer being printed.

Yes, you can go back at any time to paper statements. Visit any Trustco Bank location and a branch manager will happily assist you with switch back to paper statements.

e-Statements will be viewable online for 18 months. Therefore, we recommend that you electronically save or print a copy of each of your e-Statements for your records.

You will need your Social Security Number and your date of birth to enroll in Online Banking. The information you provide is safeguarded using secure internet data encryption technologies and is only used for setting up your account. For business customers, please visit a Trustco Bank location to request online access.

To access your online accounts, stop into any of our over 140 Branch locations and speak to the Branch Manager.

During the enrollment process, for security reasons and to maintain the confidentiality of your Login ID and password(s), you will select your own Login ID and password. You can change your password on online banking at any time. You should change your password periodically.

In terms of software requirements, we support the two most recent versions of the following browsers:

For Macintosh:

*Some areas of our site may require the use of Adobe Acrobat Reader. Other browsers and operating systems may work effectively; however, we do not test against them and therefore your experience may vary. We regularly monitor and test browsers to ensure the highest security standards.

Trustco Bank’s online banking gives you access to your accounts 24 hours a day, 7 days a week. You have the ability to:

- Review Transactions

- Balance Accounts

- Transfer fund between checking, savings and money markets accounts.

- Make Trustco loan payments by transferring directly from your checking or savings account.

- View monthly e-statements

- Free Bill Pay

- Download information to Quicken and Microsoft Money.

- Request stop payments on checks.

- Reorder checks

- Receive email and text alerts – for account balance, checks cleared, successful transfers and more!

No. You can also access your accounts using our online banking 24 hours a day.

Pending transactions are hold(s) or credit(s) place on your account affecting your available balance. Some pending deposit amounts may include funds that are being held. Some pending debits may reflect a merchant hold on your account, which may or may not be the final amount posted to your account.

If you have forgotten your Login ID or password, please call customer service at 1-800-670-4110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) in order to regain access to online banking.

Your access to online banking will be blocked in the event your Login ID or password is entered incorrectly on three consecutive access attempts. If this occurs, please call customer service at 1-800-670-4110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday).

Visit any Trustco Bank location and a branch manager will happily assist you with adding your new account to your online banking access. You can also contact customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) for assistance.

You can schedule transfers as one time transactions or as recurring events that repeat for a specified duration. Click the transfers tab, then click create a new transfer and follow the steps to complete the transfer set-up process.

You can change your Login ID or password at any time. Click on the preferences menu, here you will find a list of preference options. Click on the option you would like to perform and follow the steps to complete.

In the preferences page, click on the change account preferences option. In this option you will be able to remove any closed accounts that you no longer want to view.

Contact your local branch or call customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) immediately. Trustco Bank will never send you an email with a link to our logon page or ask you for any personal information using email.

No. Once you are enrolled in online banking, Bill Pay is a free and secure way to pay your monthly bills.

Once enrolled in our online banking, simply login and click on the Bill Pay tab. Click the Open Bill Pay button and follow the steps to complete the set-up process. Your request for Bill Pay access will be confirmed by email within 2 business days.

For Bill Pay assistance, please call 1-833-884-4716. A representative will be able to assist you with tracking your payment.

To understand how we use and protect customer information, read our Privacy Policy.

You can help safeguard your information with the following practices:

- The best ways to prevent unauthorized access to your accounts is to protect your password. Make sure it is difficult to guess, do not write it down, do not share it with anyone and change it periodically. Your password is the only way to get access to your accounts, so keep it secure.

- Do not leave your computer unattended with your personal banking session open. While there is an automatic timed log out if there is no activity, your information will be more secure if you exit your online banking before leaving your computer.

- Click EXIT when you are finished with your online banking rather then just closing your browser, or going to another web page. Use the EXIT button to make sure someone else can not access your information after you leave the computer.

You can help safeguard your information with the following practices:

- Protect your PIN # - Memorize your PIN #, do not keep this number in your wallet or purse. Do not write this number on the back of your card. Also, if you change your PIN #, select a unique PIN # and avoid using numbers such as birth date, phone number or last 4 digits of your social security number.

- Use secure sites when shopping online - When you are shopping online, do not provide your personal or financial information through a company’s website until you have checked for indicators that the site is secure (look for a lock icon on the browser’s status bar or a website URL that begins with “https:” the “s” stands for secure). Unfortunately, no indicator is a guarantee. So make sure that the site you are shopping is a trusted source.

To report suspicious email or fraud, contact your local branch or call customer service at 1-800-670-3110 (between 8:00 am and 8:00 pm, M-F, and 8:00 am and 5:00 pm, Saturday) immediately. Trustco Bank will never send you an email with a link to our logon page or ask you for any personal information using email.

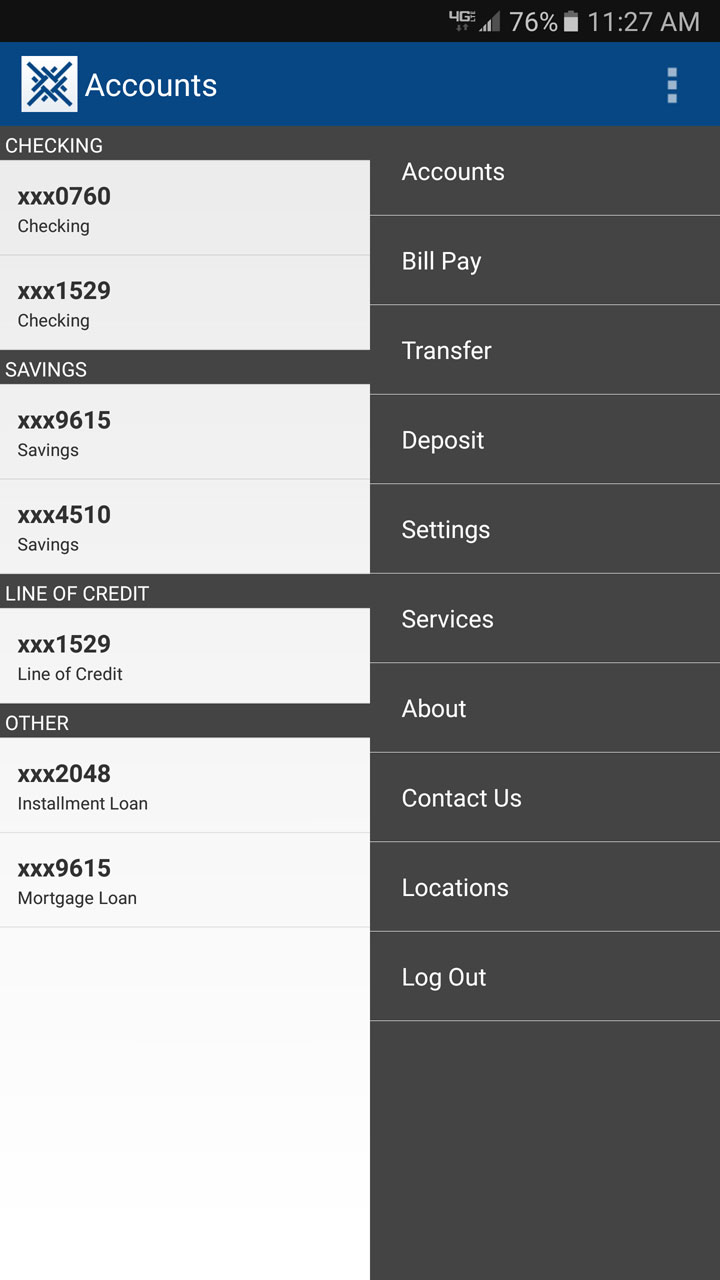

- Check your balances and transactions

- Pay bills and transfer money

- Find the nearest Trustco Branch or ATM

- Learn more about other Trustco services

- Mobile Apps- Download our free app for iPhone or Android phones (App Store®, Google Play®)

- Mobile App for iPad- Manage your account from your iPad

- Verify your mobile phone is turned on and able to receive text messages. You may need to consult your mobile carrier if you are unsure if you can receive text messages.

- Contact your mobile carrier and make sure your mobile devices is not blocked from sending and receiving SMS messages.

- Logon to your Trustco Bank Online Banking account and click the Trustco Bank Mobile link. Verify that your mobile number is entered correctly. If the correct mobile number is showing, verify the status as enrolled.

- If you still do not receive the verification code please contact customer service for assistance (1-800-670-4110)

- Yes, for increased registration security, it is required that clients are enrolled in Trustco Bank online and have a registered user ID.

- No use of identifiable information- Trustco will never transmit your full account number during you mobile banking transactions. Your account numbers will appear truncated on you mobile device screen. Trustco uses advanced encryption technology to prevent unauthorized access to your personal information.

Trustco Bank will never send full account numbers or other personal information through mobile banking. No one can access your account without knowing your unique username and password.

If your mobile device is either lost or stolen:

- Report it immediately to your mobile carrier

- Immediately log on to your Trustco Bank Online Banking account from your computer and delete the lost or stolen mobile number from your mobile settings

- If you can’t get to online banking, immediately call Trustco Bank Customer Service (1-800-670-4110) to delete your mobile number from your mobile settings

If you are unable to remember your mobile banking User ID or Password, Logon to your online Trustco Bank account under “Other Services”, choose Mobile Banking to find your Username. You may continue to use this username or choose a new one. To change your Password, click “Change Password" and choose a new password. Now enter your username and password as instructed on the mobile device.

The iPad is specifically designed for the iPad. It takes advantage of the device’s unique built-in features for a better customer experience.

Using or accessing this app or any of our others incurs no fees. Please check with your wireless provider about carrier and web access charges.

Currently, the following devices are supported by Trustco Bank

- iPhone, iPad, iPad-Mini, iPod

- Android phones

Yes, you will be able to schedule billpay payments using the Trustco app, however, for security purposes if you would like to add/delete/change a payee this must be done using your Trustco Bank online account.

Yes, to use mobile banking, you must read and accept the Trustco Banking legal terms and conditions.

Apple Pay, Android Pay, and Samsung Pay are available for all Trustco Debit Card holders that have an eligible Apple, Android, or Samsung Phone/Device.

Apple/Android/Samsung Pay is a feature integrated into the mobile pay apps on select devices that allows you to add your Trustco Debit Card. Once your card is verified, you can make purchases at participating retailers within their stores, using Near Field Communication (NFC) technology, or in app purchases.

To add your eligible Trustco Debit Card to your mobile wallet, follow the instructions provided in the Apple Pay, Android Pay, or Samsung Pay app. Each pay service provides the same benefits and protection as your actual physical debit card, with the convenience of making secure transactions on your phone/device. You can use mobile device anywhere contactless payments are accepted and to make purchases in app with participating apps.

For more details, please see the following links:

Each pay service assigns, encrypts and securely stores a Unique Device Account Number on your mobile device. When you make a purchase, that number and an individual transaction security code is used to process your payment. Your card number is never stored on your device, and when you pay your Trustco Debit Card numbers are never sent to merchants.

Apple Pay is compatible with the following Apple devices: iPhone® 7, iPhone® 7 Plus iPhone® 6, iPhone® 6S, iPhone® 6 Plus, iPhone® 6S Plus, and Apple Watch™, or newer. Apple Pay may also be used in-app with your iPhone® 6, iPhone® 6S, iPhone® 6 Plus, iPhone® 6S Plus, iPad Air™ 2, iPad Pro, iPad mini 3, iPad mini™ 4, or newer.

Android Pay is compatible with many devices. Please check with your service provider to see if your device eligible.

Samsung Pay is compatible with the following devices: Galaxy S7, Galaxy S7 Active, Galaxy S7 Edge, Galaxy S6, Galaxy S6 Active, Galaxy S6 Edge, Galaxy Note 5, Galaxy S6 Edge+, or newer.

Each pay service is integrated into the Wallet app, which is pre-installed on your device. You will have the ability to add your Trustco Debit Cards by using the camera on the device to capture your card details (follow the on-screen instructions) or by entering them manually.

The first card you add to Wallet will be your default method of payment when using Apple Pay. Changing the default card for Apple Payments to your Trustco Debit Card is easy to do.

Apple Pay - Go To: Settings > Wallet & Apple Pay > Default Card > Select Trustco Debit Card

Android Pay – Go To:Open the Android Pay app > Tap the card you want to make your default card > Tap Set as default card

Android Pay – Go To:Open Samsung Pay app > Add a credit card or debit card > Align your payment card inside the frame. Samsung Pay will automatically detect the card number and expiration date > Enter any remaining required information. Then, touch NEXT > To authenticate your identity, touch the desired verification method > Enter the OTP (One Time Password). Then, touch SUBMIT > Enter the OTP (One Time Password). Then, touch SUBMIT > Select make card default > To complete the process, touch DONE

In-Store Purchase- To make an in-store purchase with your mobile device, please hold your phone near the mobile pay enabled checkout card reader. Depending on your device, you will be prompted to holder your finger on the fingerprint scanner on your phone or enter your mobile PIN.

In-App Purchases- To make a purchase in-app with your device, select Apple/Android/Samsung Pay as the payment option in the app. You will be prompted to either hold your finger on Touch ID® for Apple, or enter your pin on Android and Samsung.

Apple/Android/Samsung Pay is available at more than a million stores and in merchant apps. Just look for the MobilePay logo at check out.

There are no charges to use these pay services from Trustco Bank; however, an active data plan is required. Based on your wireless plan and mobile carrier's service, additional message and data charges may apply. Your debit card Deposit Account Agreement will apply for purchases. Trustco Bank does not charge any fees to add your card to Apple/Android/Samsung Pay.

Yes. Apple/Android/Samsung Pay for your smart watch is not set up through Wallet app. You can load your Trustco Debit Card to the Smart Watch app on your paired device. An alert will then be displayed on the watch when the card is activated.

Yes, as long as you're shopping at a participating retailer, Apple Pay/Android/Samsung will work outside the United States. Based on your wireless plan and mobile carrier's service, additional message data charges and transaction fees may apply.

Near Field Communication (NFC) is a short-range wireless technology that allows two devices to exchange payment information at close proximity. Apple/Android/Samsung Pay uses NFC technology to transmit payment information from your phone to the payment terminal.

Apple, the Apple logo, Apple Pay, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Galaxy and Samsung Pay are trademarks of Samsung Inc., registered in the U.S. and other countries. Android Pay is a trademark of Google Inc., registered in the U.S. and other countries.

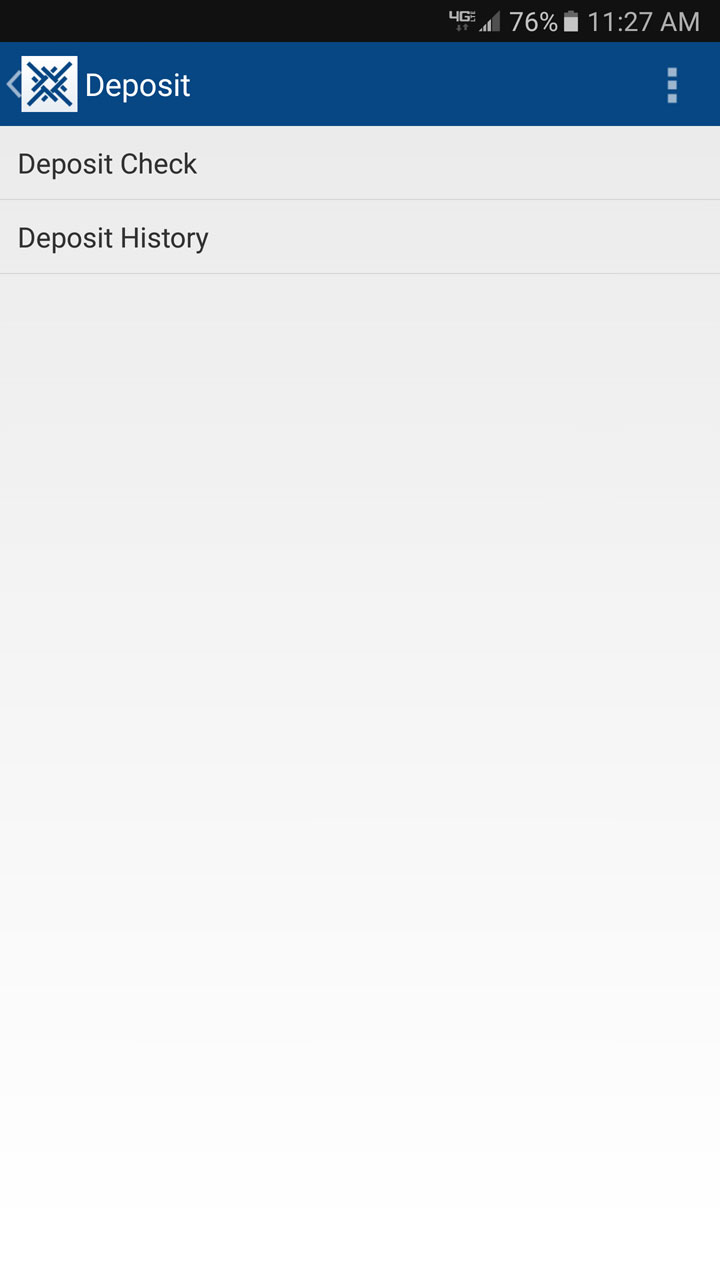

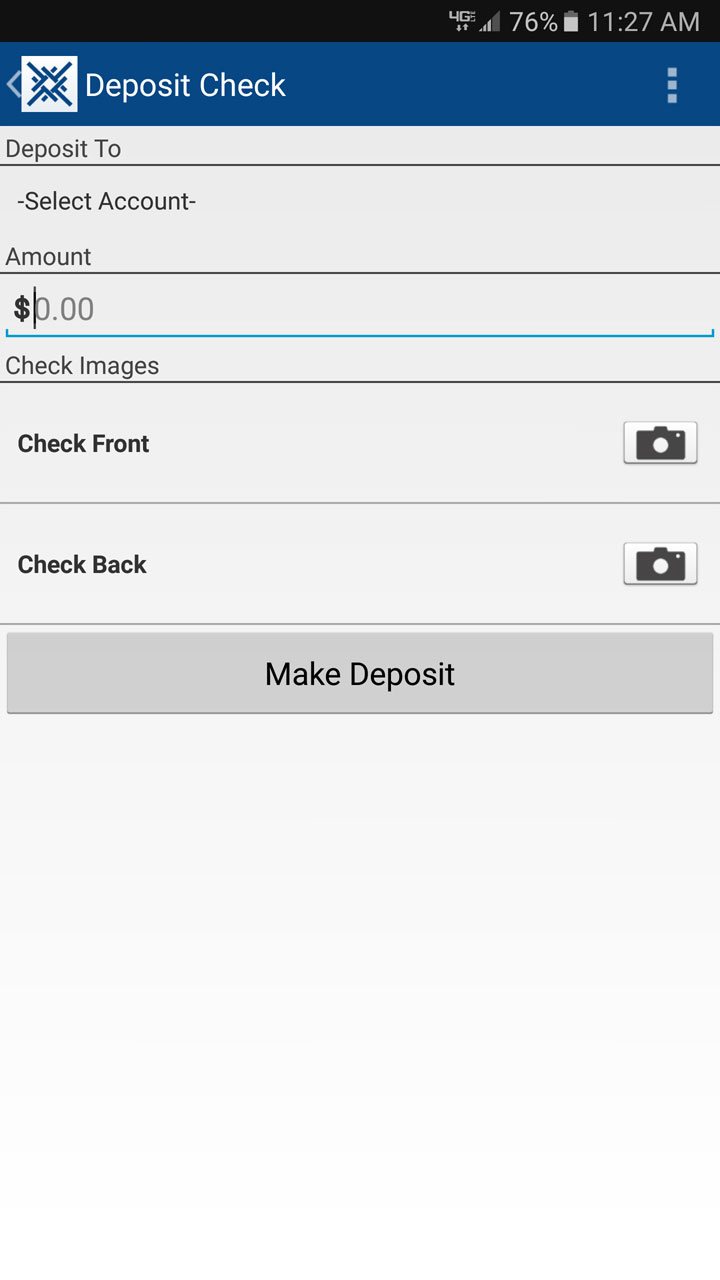

Trustco Bank Mobile Deposit is a service included in the Trustco Bank Mobile Application that allows you to deposit paper checks using a compatible mobile device at any time that is convenient for you.

- Customers with a Trustco Bank Checking Account.

- Active online/mobile banking access.

- Most current version of the Trustco Bank Mobile Application.

Yes. The back of the check must be endorsed with your signature and "For Mobile Deposit Only" prior to taking the picture of the check.

Once you have deposited the check successfully, you should keep the check in a safe place for 30 days. After the 30 days and you have confirmed the deposited funds have been credited to your account correctly, shred and dispose of the check.

There is a daily limit of 10 deposits and a maximum amount of $3,000 total. There is a monthly limit of 25 deposits and a maximum amount of $12,000 total.

There is no cost to make a deposit using the Mobile Deposit Function.

Check deposits made using the Mobile Deposit function are subject to verification and will generally be available for withdrawal within 2 business days from the date of your deposit. Some checks may be held longer for further processing. Please refer to your account disclosure for additional information regarding deposit availability. Mobile check deposits received on weekends, bank holidays and Monday through Friday after 3 pm ET are processed the following business day.

- Personal checks payable to you

- Business checks payable to you

- Checks drawn from a United States bank

- Checks payable to any person or entity other than you

- Foreign checks

- Savings bonds

- Money orders

- Traveler's checks

Follow these steps for a successful Mobile Check Deposit:

- Verify the back of your check is signed.

- Make sure the check amount entered matches the amount written on your check.

- Make sure the entire check image is visible and in focus before submitting your deposit.

- Keep your phone flat and steady above the check when taking your photos.

- The photos of the deposited check should be taken in a well-lit area.

Mobile Deposit device requirements:

-

- iPhone

Requires iOS 11.0 or later. - iPad

Requires iPadOS 11.0 or later. - iPod touch

Requires iOS 11.0 or later. - Android

Requires Android 5.0 and up

- iPhone

CardValet is a Card Controls Application that allows a Trustco Bank Debit Cardholder to manage their debit card by:

- Restrict purchases to locations, merchant categories, or transaction types

- Easily lock and unlock cards

- Set up alerts based on transaction type, merchant category, location, or even spend limit

- Check account balances and view recent debit card transactions

Usage Controls

CardValet can manage and track specific types of debit card transactions – or quickly detect unauthorized or fraudulent activity. Users can customize their experience by choosing from a variety of options.

Card On/Off Setting

- When the card is "on," transactions are allowed in accordance with their usage control settings.

- When the card is "off," no purchases or withdrawals are approved until the card is subsequently turned back "on." This control can be used to control spending, disable a lost or stolen card, or prevent fraudulent activity.

Card Controls

- Spending limits can be established to allow transactions up to a certain dollar value and decline transactions when amounts exceed defined thresholds.

- Transactions can be controlled and monitored for specific merchant categories such as gas stations, department stores, restaurants entertainment, travel, and groceries.

Location-Based Controls

- The My Location control can restrict transactions to merchants located within a certain range of a cardholder's location (using the phone's GPS); transactions requested outside of the specified range can be declined.

- The My Region control uses city, state, country or zip code on an expandable interactive map; transactions requested by merchants outside of a specific region can be declined.

Simply download the "CardValet" application from the Google Play Store or Apple App Store and complete the following steps:

- Open the CardValet application on a mobile device.

- Tap the "Get Started" link at the bottom of screen.

- Enter 16 digit card number

- Enter the card and customer identity questions

- You will be prompted to receive/enter a One Time Pin at an email address on file

- Accept terms and conditions

- Create a CardValet Account

- Select a User ID, Password

Please contact Trustco Bank Customer Service at 1-800-670-3110 to further validate your identity and help you successfully register your card in the CardValet application.

Yes, you can add up to 15 Trustco Debit Cards by clicking "Edit Cards" and then "Add New Card".

Card Valet enables the cardholder to set controls and alerts to limit fraud. These are set, and can vary, for each card registered.

- Select "Alerts and Controls" button from the main screen.

- Select "Controls" or "Alerts"

- Choose which control/alert you would like to setup from

- Locations

- Manage Spending

- Merchants

- Transaction Types

The balances are obtained in real-time when the request is made.

The CardValet app is available immediately for all debit card customers.

The most recent mobile operating software as well as two past generations of Android and iPhone devices are compatible with CardValet.

There is no fee from Trustco Bank to use the CardValet application. There may be message and data rates on your mobile device.

Zelle® is a fast, safe and easy way to send money directly between almost any bank or credit union account in the U.S., typically within minutes1. With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank1.

You can send, request, or receive money with Zelle®. To get started, log into Trustco Bank's mobile app and select "Payments" then "Send Money with Zelle®". Following the prompts, enter the information requested, accept the terms and conditions, and you're ready to start sending and receiving with Zelle®.

To send money using Zelle®, simply select someone from your mobile device's contacts (or add a trusted recipient's email address or U.S. mobile phone number), add the amount you'd like to send and an optional note, review, then hit "Send." In most cases, the money is available to your recipient in minutes1.

To request money using Zelle®, choose "Request," select the individual from whom you'd like to request money, enter the amount you'd like to request, include an optional note, review and hit "Request"2. If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile phone number.

To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Trustco Bank account, typically within minutes1.

It's easy — Zelle® is already available within the Trustco Bank mobile app! Check our app and follow a few simple steps to enroll with Zelle® today.

Your email address or U.S. mobile phone number may already be enrolled with Zelle® at another bank or credit union. Call our customer support team and ask them to move your email address or U.S. mobile phone number to Trustco Bank so you can use it for Zelle®.

Once customer support moves your email address or U.S. mobile phone number, it will be connected to your Trustco Bank account so you can start sending and receiving money with Zelle® through the Trustco Bank mobile app. Please call Trustco Bank customer support toll-free at 1-800-670-3110 for help.

When you enroll with Zelle® through your Trustco Bank app, your name, the name of your bank/credit union, and the email address or U.S. mobile number you enrolled is shared with Zelle® (no sensitive account details are shared – those stay with Trustco Bank). When someone sends money to your enrolled email address or U.S. mobile phone number, Zelle® looks up the email address or mobile number in its "directory" and notifies Trustco Bank of the incoming payment. Trustco Bank then directs the payment into your Trustco Bank account, all while keeping your sensitive account details private.

Keeping your money and information safe is a top priority for Trustco Bank. When you use Zelle® within our mobile app, your information is protected with the same technology we use to keep your Trustco Bank account safe.

You can send money to friends, family and others you trust even if they have a different bank or credit union1.

Since money is sent directly from your Trustco Bank account to another person's bank account within minutes1, it's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile phone number.

If you don't know the person, or aren't sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle®.

These transactions are potentially high risk (just like sending cash to a person you don't know is high risk). Neither Trustco Bank nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

Zelle® is a great way to send money to friends, family, and people you are familiar with such as your personal trainer, babysitter, or neighbor1.

Since money is sent directly from your Trustco Bank account to another person's bank account within minutes1, Zelle® should only be used to send money to friends, family, and others you trust.

Neither Trustco Bank nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

Some small businesses are able to receive payments with Zelle®. Ask your favorite small business if they accept payments with Zelle®. If they do, you can pay them directly from your Trustco Bank mobile app using just their email address or U.S. mobile number.

Neither Trustco Bank nor Zelle® offers a protection program for any authorized payments made with Zelle®, so you should only send money to people (and small businesses) you trust. Also, always ensure you've used the correct email address or U.S. mobile number when sending money.

In order to use Zelle®, the sender and recipient's bank or credit union accounts must be based in the U.S.

You can only cancel a payment if the person you sent money to hasn't yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn't yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select "Cancel This Payment." If you do not see this option available, please contact our customer support team at 1-800-670-3110 for assistance with canceling the pending payment.

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled. This is why it's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, please immediately call our customer support team at 1-800-670-3110 so we can help you.

You can find a full list of participating banks and credit unions live with Zelle® here.

If your recipient's bank or credit union isn't on the list, don't worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

Yes! They will receive an email or text message notification via the email or U.S. mobile number they used to enroll with Zelle®.

If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Trustco Bank account, typically within minutes1.

If you have not yet enrolled with Zelle®, follow these steps:

- Click on the link provided in the payment notification you received via email or text message.

- Select Trustco Bank.

- Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile phone number where you received the payment notification - you should enroll with Zelle® using that email address or U.S. mobile phone number to ensure you receive your money.

Money sent with Zelle® is typically available to an enrolled recipient within minutes.

If you send money to someone who isn't enrolled with Zelle®, they will receive a notification prompting them to enroll. After enrollment, the money will be sent directly to your recipient's account, typically within minutes.

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle® and that you entered the correct email address or U.S. mobile phone number.

If you're waiting to receive money, you should check to see if you've received a payment notification via email or text message. If you haven't received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Still having trouble? Please give the Trustco Bank customer support team a call toll-free at 1-800-670-3110 or get in touch through our support page.

The FDIC (Federal Deposit Insurance Corporation) is an independent agency of the United States government that protects bank depositors against the loss of their insured deposits in the event that an FDIC-insured bank or savings association fails. FDIC insurance is backed by the full faith and credit of the United States government.

FDIC deposit insurance protects bank customers in the event that an FDIC-insured depository institution fails. Bank customers don’t need to purchase it; it is automatic for any deposit account opened at an FDIC-insured bank. Deposits are insured up to at least $250,000 per depositor, per FDIC-insured bank, per ownership category.

Deposit insurance is calculated dollar-for-dollar, principal plus any interest accrued or due to the depositor, through the date of default. For example, if a customer had a CD account in her name alone with a principal balance of $195,000 and $3,000 in accrued interest, the full $198,000 would be insured.

Click here and we will call you