If you’ve ever tried to buy a home and felt overwhelmed by mortgage rates, you’re not alone. Many first-time buyers thought rates were just numbers on a page, until they realized how powerfully those numbers shape their budget.

Even a 1% rate difference can shift your monthly payment by hundreds of dollars.

In this guide, you’ll learn what truly drives mortgage rates, how 2026 trends might impact you, and how to secure the best possible rate with a trusted lender.

What Are Mortgage Rates?

Mortgage rates are the interest charges you pay when borrowing money to buy a home. They’re a huge part of your long-term cost, and one of the biggest decisions in your home-buying journey.

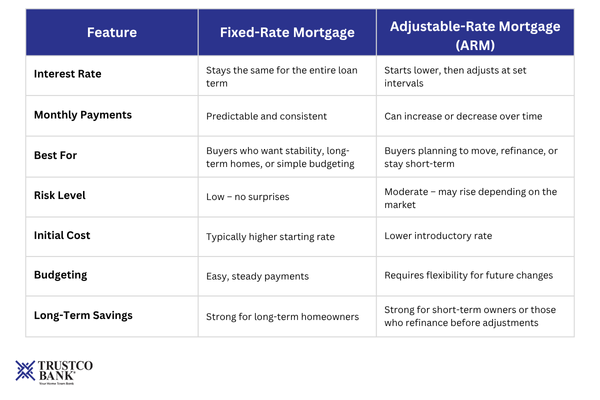

Fixed vs. Adjustable Rates

There are two common types of rates you’ll encounter, fixed-rate mortgage rates and adjustable-rate mortgage rates.

Fixed Rates

These stay exactly the same for the entire loan term, no surprises, no fluctuations. They’re ideal if you want predictable payments, long-term stability, and easy budgeting.

Adjustable-Rate Mortgages (ARMs)

These start with a lower introductory rate, then adjust at scheduled intervals. They can be powerful tools if you plan to move, refinance, or only hold the home for a short period before the rate changes.

So what does this mean for your budget?

How Rates Affect Affordability

A lower mortgage rate means more buying power. Even small shifts can affect your home choices and monthly payments.

That’s why timing, preparation, and choosing the right lender can make a meaningful difference in your long-term financial stability.

Factors Influencing Mortgage Rates in 2026

Mortgage rates in 2026 will be shaped by several key economic forces. Let’s break down the big ones.

Federal Reserve Policies

The Fed doesn’t set mortgage rates directly, but its decisions on inflation and interest rate targets influence the cost of borrowing nationwide.

If the Fed continues focusing on inflation control in 2026, rates may remain steady but sensitive to economic shifts. That’s why watching Fed updates is crucial.

Housing Market Trends

When home demand goes up, mortgage activity rises, and rates often follow. Low inventory in many states is still putting pressure on pricing.

If 2026 brings new housing developments or buyer incentives, rates may stabilize through increased supply. But if demand continues to surge, expect higher competition.

But there’s another piece: your personal financial profile.

Credit Score & Borrower Profile

Your credit score tells lenders how reliably you manage debt. Higher scores unlock better rates, lower fees, and more flexible loan options.

Debt-to-income ratio, employment history, and loan type also play a major role. The stronger your profile, the more negotiating power you gain.

This means, if possible, don’t switch jobs before applying for a mortgage.

Loan Type, Term, and Amount

The type of loan you choose, FHA, VA, conventional, jumbo, etc., can influence your mortgage rate. Some programs offer lower rates because they’re backed by federal insurance or designed for specific buyers.

Your loan term matters too. Shorter terms (like 15-year mortgages) often come with lower rates, while longer terms may cost more.

Then there is the loan amount itself. Small mortgages with a lower loan amount may have a higher average rate since they are less profitable for the lender.

Down Payment

Your down payment also plays a huge role in determining your mortgage rate. The more you put down, the less risk the lender takes on.

Higher down payments can:

- Unlock better rates

- Reduce your monthly payment

- Eliminate mortgage insurance

Even an extra 2–5% down can make a noticeable difference in affordability.

Why Banks Offer More Competitive Mortgage Rates

Not all lenders operate the same way. Banks often have advantages that directly benefit borrowers.

Access to Diverse Loan Products

Banks frequently offer a wider range of mortgage programs. That means more flexibility and more chances to find the perfect fit for your financial goals.

These loan options often include:

- Fixed-rate mortgages for predictable monthly payments

- Adjustable-rate mortgages (ARMs) for lower introductory rates

- Jumbo loans for higher-priced homes

- FHA loans for buyers needing flexible credit or lower down payments

- VA loans for eligible veterans and service members

- First-time buyer programs with special incentives and reduced costs

More choices mean more opportunities to save.

Easier Financing Options

Banks can streamline the mortgage process because everything is handled under one roof. This can lead to quicker approvals, simpler communication, and smoother underwriting.

When time is of the essence, efficiency matters. This can make all the difference in a competitive housing market.

Rate Locks

A rate lock allows you to freeze your mortgage rate during the application process. This protects you from market fluctuations while you complete paperwork and wait for approval.

Rate locks give peace of mind, especially if rates are rising, so you know exactly what you’ll pay.

Flexible Terms

Flexible terms let you customize the length or structure of your mortgage to fit your budget and goals. Options can include different loan durations, payment schedules, or early payoff features.

This flexibility helps you align your mortgage with your financial plan, whether you’re focused on long-term stability or short-term savings.

Tips for Securing the Best Mortgage Rates

Ready to take control of your mortgage journey? Here’s how to boost your chances of landing the lowest possible rate.

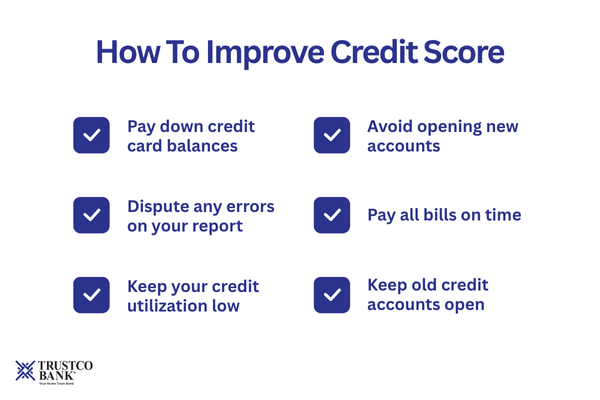

Improve Your Credit Score

Here’s how you can improve your credit score.

- Pay down your credit card balance – Lower balances improve your utilization ratio and can boost your score quickly.

- Dispute any errors on your report – Incorrect late payments or wrong account information can drag down your score, so fix them fast.

- Keep your credit utilization below 30% – Using too much of your available credit signals risk to lenders.

- Avoid opening new accounts before applying – Each credit inquiry can temporarily lower your score, so hold off until after your mortgage closes.

- Pay all bills on time, every time – Payment history is the biggest factor in your score, and consistency builds trust with lenders.

- Keep old credit accounts open – Longer credit history shows stability and can help increase your overall score.

While it may seem daunting, small steps can equal big savings.

Work With a Trusted Bank Lender

A knowledgeable lender helps you navigate options and secure the most competitive rate. They’ll guide you through paperwork, explain terms, and flag savings opportunities.

Banks can give you direct access to experienced mortgage specialists. That expertise can save you thousands over the life of your loan.

Want to make the process even smoother? Keep reading to find out how.

Get Pre-Approved Early

Pre-approval shows sellers you’re serious and financially prepared. It also gives you a clear picture of your buying budget.

Better yet, early pre-approval can help you lock in better rates while the market fluctuates. This gives you a major advantage when making offers.

How to Apply for a Mortgage

Trustco Bank makes applying simple and stress-free. Here’s the typical process for applying for a mortgage:

- Gather essential documents like tax returns, pay stubs, and bank statements

- Submit your application with help from your mortgage specialist

- Lock in your rate and prepare for underwriting

- Get ready for closing day!

If you want a step-by-step breakdown of what documentation you need, check out our comprehensive mortgage application checklist.

Get a Competitive Mortgage Today

Understanding mortgage rates doesn’t have to feel overwhelming, especially as you prepare for homebuying in 2026.

Are you ready to explore your mortgage options, lock in a strong rate, and feel confident about your next financial move? Trustco Bank’s mortgage experts are here to help you secure the best possible rate with personalized guidance and dependable support.

Start a mortgage application today and take the first step toward the home you’ve been dreaming of!