Our Mission

The mission of Trustco Bank is to be the low cost provider of high quality services to our customers in the communities we serve and return to our owners an above average return on their investment.

We Are Trustco Bank

Trustco, your Home Town Bank.

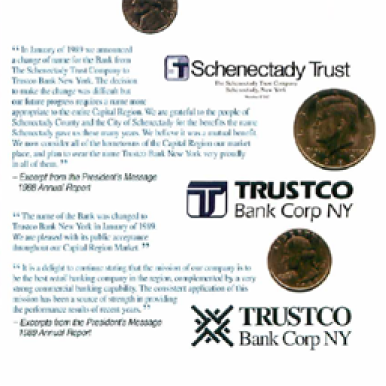

Trustco Bank has been the low cost provider of high quality products and services since opening for business in 1902 in the upstate town of Schenectady, New York. Throughout this time Trustco Bank has remained true to core banking principles and did not get caught up in any of the latest banking fads that have caused so many other banks to close their doors over the years. In 2002, the company began a large expansion, opening over 80 new branches in Central Florida, Massachusetts, downstate New York, New Jersey, and Vermont.

147 Branches

Today, Trustco Bank has 147 branch locations, 53 of which are in the state of Florida. The Bank believes in old school, personal service and welcomes each customer by name as they enter the branch. Offering a wide variety of great deposit and loan products, the bank specializes in residential mortgage lending. As of December 31, 2021, Trustco Bank' s assets were $6.2 Billion. Trustco Bank has paid dividends to its shareholders for over 100 consecutive years, and has remained profitable throughout its history, including the recent financial crisis. In April 2018, S&P Global Intelligence rated Trustco Bank the 15th best performing savings bank in the country. Trustco Bank is traded on the NASDAQ under TRST.

In 2021 Trustco Bank received numerous accolades and reached significant milestones:

A Letter from our President & CEO

Dear Friends,

Welcome to Trustco Bank.

These days, it seems many people are rediscovering the value of taking a conservative approach with their money. At Trustco Bank, we have been doing just that since 1902.

Our commitment to careful financial management, and high quality personal service has never wavered. We focus on providing our customers with community banking solutions that offer superior value, security, and great Home Town service.

Whether it be our branch personnel welcoming you by name or being able to easily reach a real person by telephone, Trustco offers the kind of old fashioned personal service that in today’s world is hard to find. When such services are combined with our offerings of low cost deposit and mortgage products, it is clear why Trustco is one of the highest rated and most successful banks in the country.

In these uncertain times, you can understand why so many of your friends and neighbors are moving to a Home Town bank with a history of financial strength. To learn more about our history, we've included a link to Trustco, 110 Years of Excellence.

Thank you. We look forward to building a relationship and providing you with all your future banking needs.

Sincerely,

Robert J. McCormick,

President and CEO